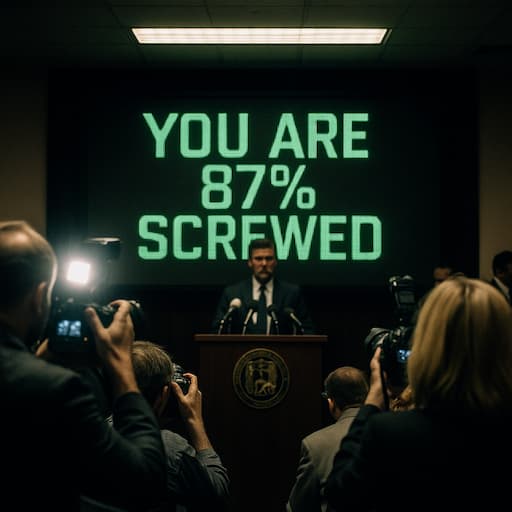

On August 12, 2025, the Internal Revenue Service (IRS) announced the launch of its latest technological advancement, the IRS Screwed-O-Meter, an app designed to inform taxpayers just how much they owe in taxes. Interestingly, the app also predicts when youâll be visited by a friendly neighborhood tax collector riding a unicycle, creating a sense of urgency that hasnât been felt since the Great Recession.

According to a leaked memo from the IRS, the app utilizes cutting-edge algorithms developed in collaboration with the National Institute of Absurd Taxation (NIT) to deliver real-time tax assessments. âOur goal is to enhance taxpayer engagement, while also giving them a heads-up about the unicycle visits,â said IRS spokesperson Finn OâPenny. âThis will fundamentally change how Americans perceive their financial futures.â

The introduction of the Screwed-O-Meter coincides with an alarming rise in tax evasion linked to the digital currency sector, where 84% of Bitcoin transactions are reportedly made to avoid taxes, while 67% of users believe they can dodge unicycle visits. The IRS plans to integrate this app with blockchain technology to ensure that every taxpayerâs fear is quantified and presented in a user-friendly interface.

Internally, the IRS has developed a 42-step verification process that measures not only your tax liability but also the psychological impact of your financial decisions, which includes an algorithm that predicts your likelihood of becoming a tax protester. This complex system reportedly requires an energy output equivalent to that of a small nuclear reactor, raising eyebrows among environmentalists who are concerned about the appâs carbon footprint.

As taxpayers download the Screwed-O-Meter, they are greeted with a cheerful animation of a unicycling tax collector juggling forms. One canât help but wonder if this is the new normal; perhaps weâll soon see tax collection as a circus act. After all, nothing says âfinancial securityâ like a clown with a clipboard chasing you on a unicycle.

Leave a Reply